The Basic Principles Of Summitpath Llp

The Basic Principles Of Summitpath Llp

Blog Article

Getting My Summitpath Llp To Work

Table of ContentsSummitpath Llp Things To Know Before You Get ThisNot known Details About Summitpath Llp All about Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is Talking About

Most lately, released the CAS 2.0 Technique Advancement Coaching Program. https://freeseolink.org/SummitPath-LLP_379417.html. The multi-step training program consists of: Pre-coaching placement Interactive group sessions Roundtable discussions Individualized coaching Action-oriented mini prepares Firms wanting to broaden into advising solutions can likewise turn to Thomson Reuters Technique Ahead. This market-proven method provides content, tools, and advice for companies interested in advising solutionsWhile the changes have actually opened a number of growth opportunities, they have likewise resulted in challenges and concerns that today's companies need to have on their radars. While there's variance from firm-to-firm, there is a string of typical obstacles and issues that often tend to run market large. These include, but are not restricted to: To stay competitive in today's ever-changing regulative environment, companies need to have the capacity to rapidly and effectively conduct tax obligation study and boost tax obligation reporting effectiveness.

Driving greater automation and ensuring that systems are securely incorporated to enhance workflows will help relieve data transfer problems. Companies that continue to run on siloed, legacy systems risk losing time, cash, and the depend on of their customers while raising the possibility of making errors with hand-operated access. Leveraging a cloud-based software application solution that works flawlessly with each other as one system, sharing data and processes across the firm's operations, can show to be game-changing. Furthermore, the brand-new disclosures may result in an increase in non-GAAP measures, historically a matter that is very inspected by the SEC." Accounting professionals have a lot on their plate from regulatory modifications, to reimagined organization models, to a boost in customer expectations. Equaling it all can be challenging, however it does not need to be.

Some Known Incorrect Statements About Summitpath Llp

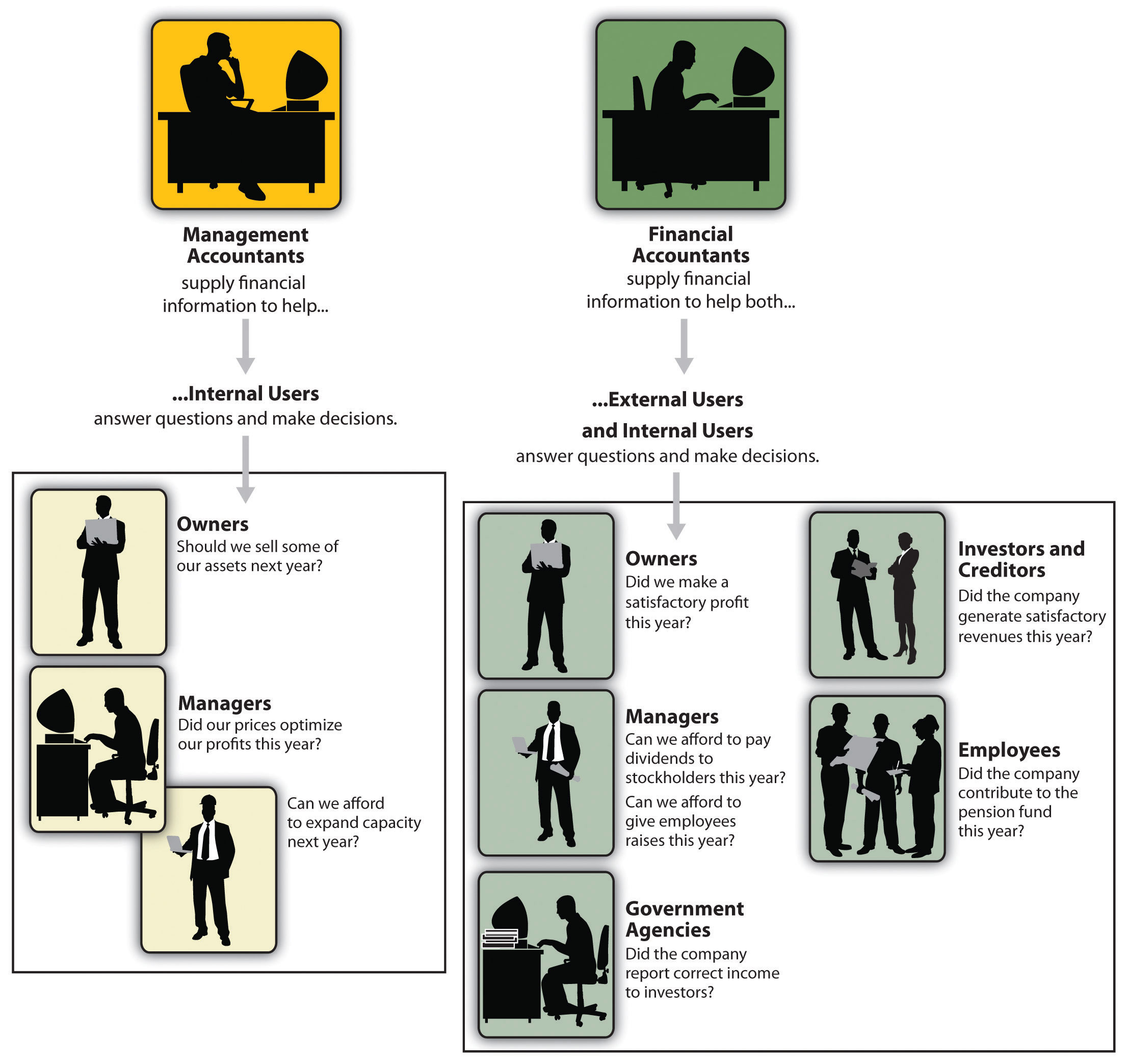

Below, we describe four CPA specializeds: taxes, management bookkeeping, economic coverage, and forensic bookkeeping. Certified public accountants focusing on taxation help their clients prepare and file income tax return, minimize their tax obligation concern, and prevent making mistakes that can result in expensive penalties. All Certified public accountants need some understanding of tax obligation legislation, however specializing in tax indicates this will certainly be the focus of your job.

Forensic accountants usually start as basic accountants and move into forensic accounting roles gradually. They need strong analytical, investigative, organization, and technical accountancy abilities. CPAs who specialize in forensic accountancy can sometimes go up right into administration accounting. Certified public accountants require at the very least a bachelor's level in bookkeeping or a comparable field, and they need to finish 150 credit scores hours, consisting of audit and organization classes.

No states call for a graduate level in audit. An bookkeeping master's level can assist trainees fulfill the certified public accountant education requirement of 150 credit scores considering that many bachelor's programs just call for 120 credit ratings. Bookkeeping coursework covers subjects like financing - https://www.bitsdujour.com/profiles/ZIxKju, auditing, and tax. Since October 2024, Payscale reports that the typical yearly wage for a CPA is $79,080. tax preparation services.

Accounting likewise makes useful feeling to me; it's not just theoretical. The Certified public accountant is an essential credential to me, and I still obtain continuing education debts every year to maintain up with our state demands.

The Greatest Guide To Summitpath Llp

As an independent specialist, I still use all the standard foundation of audit that I discovered in university, seeking my certified public accountant, and operating in public accounting. Among the things I truly like about bookkeeping is that there are many various tasks available. I determined that I wished to start my occupation in public bookkeeping in order to find out a great deal in a brief time period and be exposed to different sorts of customers and various locations of accountancy.

"There are some offices that don't intend to think about someone for an accountancy role who is not a CPA." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A CPA is a very useful credential, and I intended to position myself well in the industry for different tasks - CPA for small business. I determined in college as an accountancy major that I intended to try to obtain my CPA he said as quickly as I could

I have actually met a lot of excellent accountants who do not have a CPA, however in my experience, having the credential really aids to market your experience and makes a difference in your settlement and career options. There are some work environments that don't intend to consider somebody for an accountancy role who is not a CPA.

The smart Trick of Summitpath Llp That Nobody is Discussing

I truly appreciated functioning on various types of jobs with different customers. In 2021, I decided to take the following action in my accountancy profession trip, and I am now a self-employed audit specialist and organization expert.

It proceeds to be a growth location for me. One crucial top quality in being a successful CPA is genuinely appreciating your customers and their services. I enjoy functioning with not-for-profit clients for that really factor I seem like I'm truly adding to their goal by assisting them have good economic information on which to make smart organization choices.

Report this page